The Farc warned that military operations are putting its cease fire at risk, and look bent on keeping the progress in Havana as slow as possible. It also said that a popular referendum on the agreement does not represent the organization.

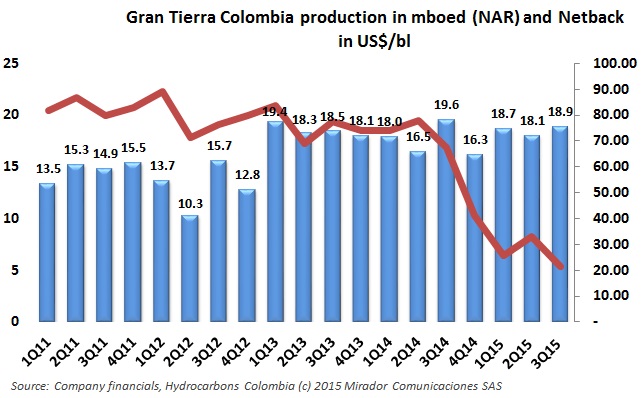

Gran Tierra’s (TSX:GTE) new management team has promised to refocus the company on Colombia and they did manage to have nearly 5% growth in Colombian production in 3Q15 although it remains within the same band as the last three years.

Nearly three thousand Colombians have benefited from Ecopetrol’s (NYSE:EC) professional training initiative over the last year, while Hocol invests in sponsoring local festivals. These and other stories on Corporate Social Responsibility (CSR) in our periodic summary.

The president of the Colombian Natural Gas Association Eduardo Pizano says that there must be an emphasis on finding new gas to meet the demand, and that without these discoveries it will be impossible to justify more distribution infrastructure.

A national paper has published a report pointing out the importance of creating stimulus measures to invest in secondary recovery, which would allow vital reserve growth from Colombia’s existing fields.

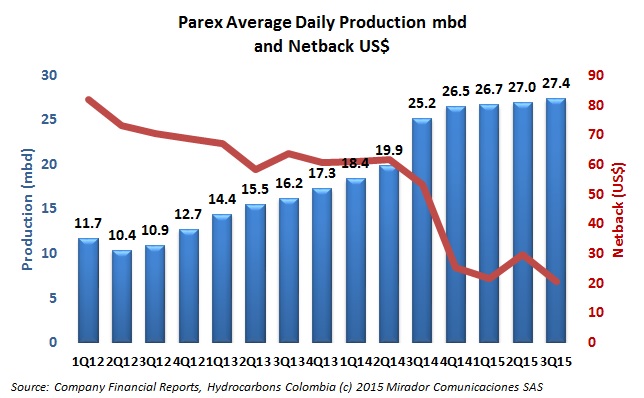

Oil company shareholders are not having a good year, hurt by continuing low oil prices. However Parex (TSX:PXT) 3Q15 results should make its investors happier than most.