A few years ago, it seems that there was an oil conference every other week in Colombia. Low oil prices killed that trend but, considering its longer time frame (relatively unaffected by current price woes), offshore is the new ‘belle of the ball’ and so there is a flurry of related events.

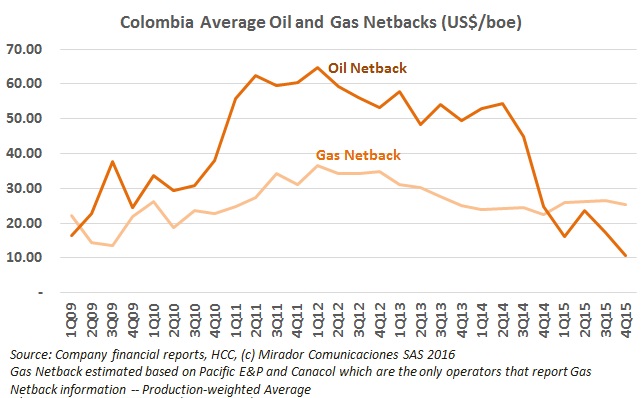

Last week we updated our estimates of netback and Production and Transport costs for crude oil. This week we look at gas and although the sample size is much smaller, gas widened its advantage over crude oil in terms of netback.

The USO has jumped into the controversy surrounding the environmental license of Hupecol in La Macarena, warning of the damage which could occur from granting licenses like these.

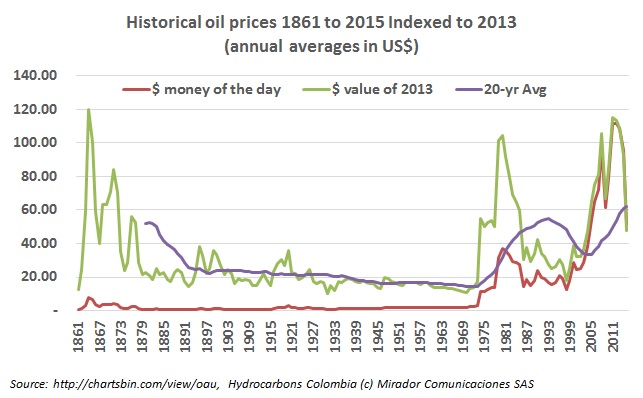

About twice a year we have a reason to publish a long term graph with oil prices in real terms going back to 1986. We had heard of but not found a series going back to the 1920s. Last week at the Association International of Petroleum Negotiators (AIPN) meeting in Bogotá, we saw a graph going back to 1861. The source for this proved easy to find and so appears above.

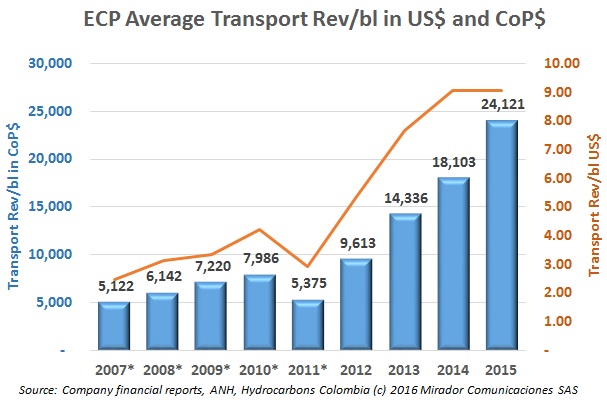

Following on his order to study tax breaks for the oil industry, President Juan Manuel Santos has now called on sector entities to study a reduction in pipeline rates to boost the industry’s financial standing.

The National Hydrocarbons Agency (ANH) is defining the final terms of its “Permanent and Dynamic Area Assignment” plan and then will send it for review to the Superintendence of Industry and Commerce (SIC), so that the parameters will be ready by the end of the month. The first “mini-round” would then occur at the end of May or latest by June.