Ecopetrol (NYSE:EC) says that it has exceeded expectations to reduce its CO2 emissions in 2014, Gran Tierra Energy (TSX:GTE) shares its reforestation experiences in Mexico and illegal refineries are blamed for contaminating rivers in Nariño. These and other environmental stories in our periodic summary.

Pacific Rubiales (TSX:PRE) CEO Ronald Pantin struck back at rumors that the Company was in danger of not fulfilling its financial obligations and that it is in good standing to continue operating even with a low price of oil.

The general manager of the Barrancabermeja Refinery shot back at critics saying that the project has not been frozen nor canceled, but still awaits definitions from the Ecopetrol (NYSE:EC) board of directors.

Ecopetrol (NYSE:EC) has a number of Corporate Social Responsibility Programs (CSR) related to risk prevention and wildlife preservation, while Pacific Rubiales (TSX:PRE) is completing an adult literacy program in Casanare. These and other CSR related stories in our periodic summary.

Gran Tierra Energy (TSX:GTE) again reduced its Capex Budget to US$140M from US$310M for 2015 due to the continued fall in the price of oil and the reevaluation downward of its reserves in Peru. The company’s CEO Dana Coffield’s employment has also been “terminated”.

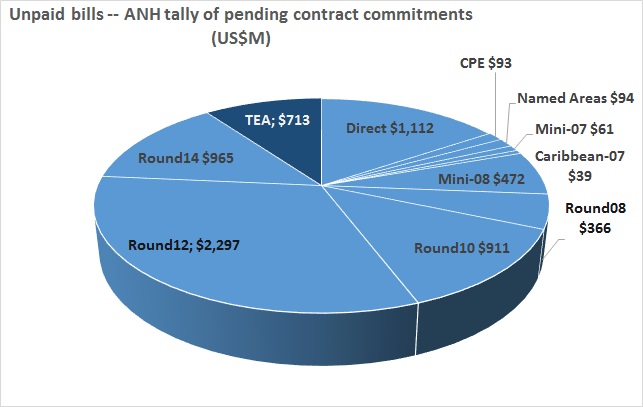

In a presentation to the industry and other interested parties at the ANDI’s ‘Genera’ conference recently, the ANH showed a chart saying there was just over US$7B of investment pending from E&P and TEA contracts.