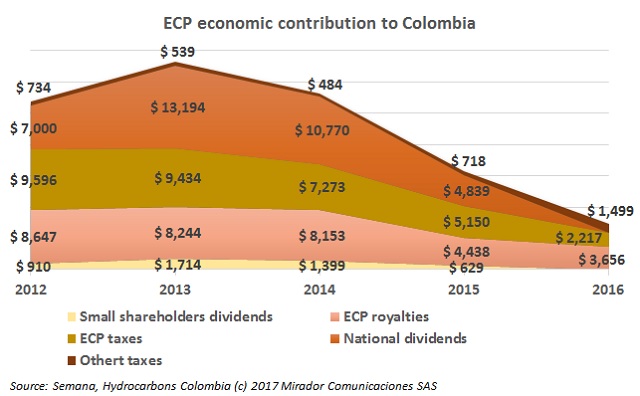

The oil industry is facing difficult times, but this sector has an important role in the Colombian economy and in the State’s income. Ecopetrol (NYSE: EC), the main player in this industry, is vital to Colombian finances.

Ecopetrol (NYSE:EC) announced that 98% of its skilled and unskilled labor in Huila are locals, and that social investment programs in 53 municipalities of Colombia are developing in a successful way.These and other Corporate Social Responsibility (CSR) stories in our periodic summary.

Between the end of July and the beginning of August of this year, the National Hydrocarbons Agency (ANH) will start offering new blocks, following the permanent allocation scheme that it announced recently.

No, we are not shifting Hydrocarbons Colombia into mining. Yes, we already wrote about Cajamaraca. But this unfortunate decision sets difficult precedents for the oil and gas industry.

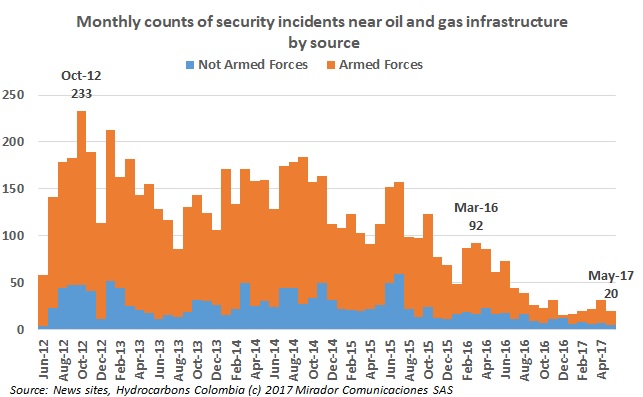

Our counts of security incidents near oil and gas infrastructure dropped again this past month, plumbing new lows since we started keeping statistics in 2012.

Last October, Leopoldo Olavarría and the team at Norton Rose Fulbright offered to write a series of articles on the draft of Agreement 2 that was circulating at that time.