Social conflict continues to be one of the main problems for oil companies in the country. Equion and Ecopetrol (NYSE: EC) reported protests and blockades in Casanare, generating possible gas shortages.

The the National Association of Financial Institutions (ANIF) and Fedesarrollo, among others, spoke about the fiscal challenges that Colombia’s new president, Ivan Duque, has ahead.

Canacol Energy Ltd. (TSX: CNE) announced positive results in its exploration program during this year. In addition, the company provided updates on its 2018 drilling program.

The sponsor spoke about a bill in the Senate that seeks to set at least 35% of the General Royalty System (SGR) budget for education in Colombia. These and other stories in our periodic Royalties summary.

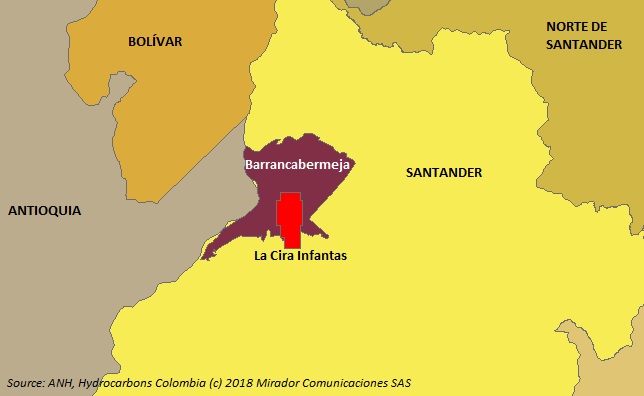

Ecopetrol (NYSE: EC) announced important news about the Infantas Oriente field, located in the municipality of Barrancabermeja in the department of Santander. This area is only 3km from the Cira-Infantas field and very close to the Barrancabermeja Refinery.

Asojuntas; an association dedicated to defending the rights of locals in El Morro village (Casanare), announced blockades at Equion’s facilities, arguing that the company is allegedly implementing fracking.