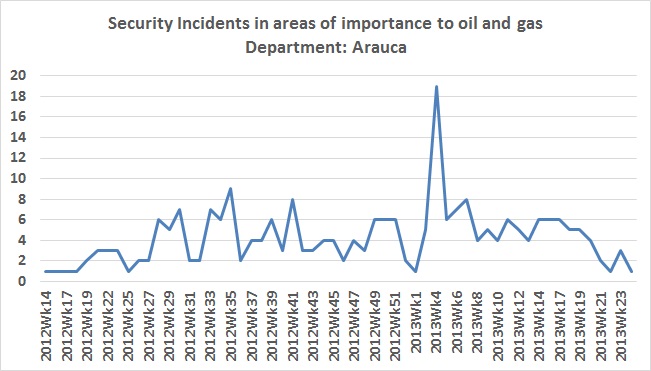

Law enforcement and officials from the Arauca Department held an extraordinary meeting of the region’s security council to analyze the wave of terrorist activity which has fell upon the department.

Colombia’s Energy & Gas Regulation Commission (CREG) has started the process to contract an administrator of the natural gas market, part of its long term wide reaching evolution of how the gas market is regulated.

Ecopetrol (NYSE:EC) says that it signed CoP$14T (US$7.44B) worth of contracts with suppliers from January to September of this year, of which 92% went to Colombian companies.

After a rise in terrorist activities targeting energy infrastructure, kidnappings and extortion in Eastern Colombia the national police, Ecopetrol (NYSE:EC) and the Attorney General’s office have signed a cooperation agreement to combat the rise in security threats.

A total of 46 oil producers in Colombia, roughly 70% of the industry, say that operational restrictions from community blockades are a primary concern when operating in the country.

After a rise in terrorist activities targeting energy infrastructure, kidnappings and extortion in Eastern Colombia the national police, Ecopetrol (NYSE:EC) and the Attorney General’s office have signed a cooperation agreement to combat the rise in security threats.