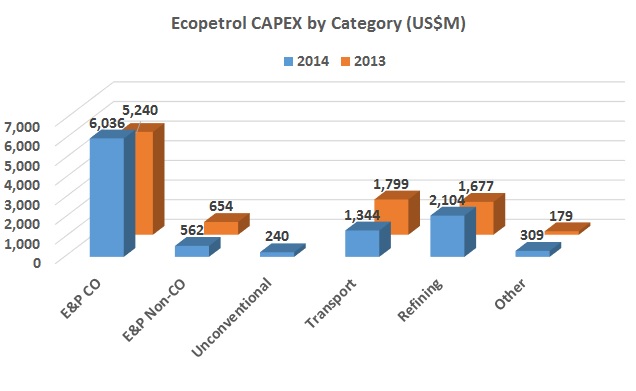

Ecopetrol’s board recently approved the company’s CAPEX budget as we reported yesterday in an article that focused on the Refining and Petrochemical business. Today we step back to look at the panorama.

Senator Maritza Martínez criticized the government’s failure to address land right issues in the Llanos and sounded off on environmental issues, many of which she says stem from mining and hydrocarbons production. Tauramena should be seen as a wake up call for the government and environmental authorities, she argues.

A required step to implement large scale projects for the hydrocarbons industry and beyond, prior consultations are becoming an obstacle to new projects rather than a forum for dialogue. In 2013, numbers from the Interior Ministry confirms the process fails to produce an agreement 67% of the time.

The National Hydrocarbons Agency (ANH) has released three key documents that will establish the regulatory structure to be used for unconventional E&P, and will accept comments from third parties this week.

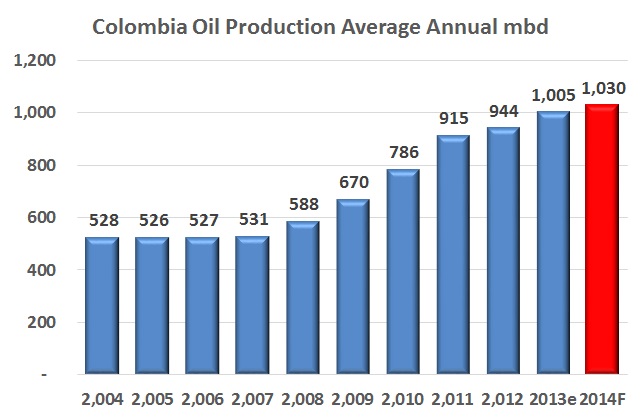

The Colombian Petroleum Association (ACP) says growth next year will only be 2.3% which means a projection of 1.03mmbd versus the expected result for this year of 1.006mmbd. The graph shows this means fairly flat growth.

Looking to brush off concerns that the recent vote against oil production in the Tauramena Municipality, The Minister of Mines and Energy (MinMinas), Amylkar Acosta said that the government has been meeting with local authorities and there are already laws on the book that adequately address the protection of water resources.