As the Cartagena Refinery (Reficar) shows signs of operational life after a long delayed modernization project and appears ready to launch, the USO has started to voice its “reservations” on the project, its operators and alleged health consequences for workers.

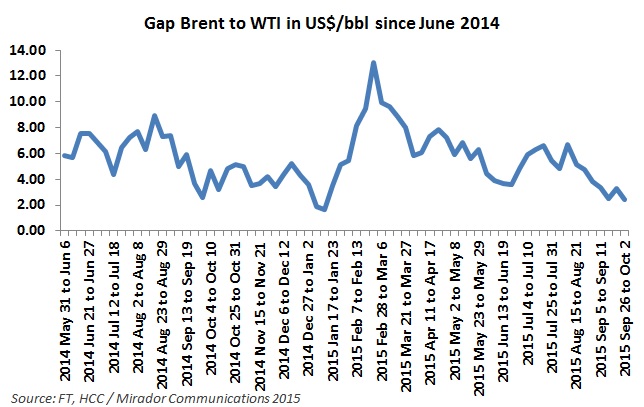

Ecopetrol is following the lead of other producers in Latin America and OPEC members by importing light crude from Nigeria and Russia to mix with its heavy crude production and fetch a better international price, fostered by a shrinking gap between the Brent and WTI prices.

The legislative bill containing the constitutional reforms to facilitate the Havana agreements on peace passed their first debate in one session, but its main critics in the Centro Democrático party abstained, leading to confrontations with supporters of the bill.

The fact that biofuels do not need to be refined from crude, which first must be found and extracted, plus their environmental benefits make them a strategic bet that Colombia must consider, says the president of the biofuels association, (Fedebiocombustible) Jorge Bendeck.

The General Controller performed an audit of the Colombian Petroleum Institute (ICP), the research institute of Ecopetrol (NYSE:EC) and found 15 administrative findings, two fiscal and four “disciplinary” cases in its contracts worth a total of CoP$1.072B (US$370,000). Questions on an unsuccessful building of a butterfly sanctuary were also raised.

The legislative bill containing the constitutional reforms to facilitate the Havana agreements on peace passed their first debate in one session, but its main critics in the Centro Democrático party abstained, leading to confrontations with supporters of the bill.