The Bank of Bogotá produced a report in which it detailed the impact of four different oil price scenarios, and how these would affect the Colombian peso to US dollar exchange rate exchange rate, and as a result, government finances.

The blame game is in full effect, and now the General Controller has said the Cartagena Refinery contractor charged with the cost laden modernization project CB&I (NYSE:CBI) is looking to pull out of Colombia without passing over documents requested by the control entity in an audit of the project.

Former head of the National Hydrocarbons Agency (ANH) and now a university professor in Scotland, Armando Zamora says that communities, the government and the industry must be clear that the oil bonanza has ended, and that we are entering “the third age of oil”.

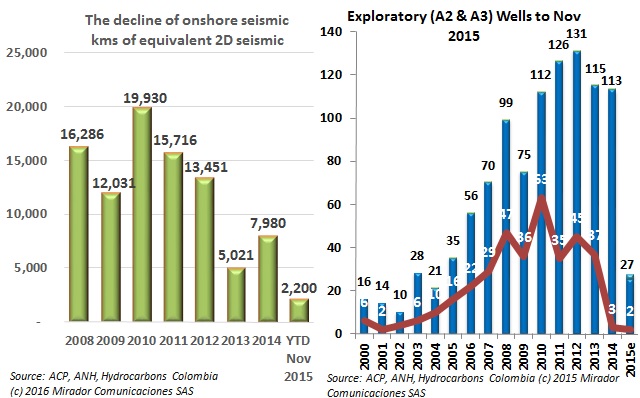

Figures from the National Hydrocarbons Agency (ANH) confirm what many have said since the middle of last year: 2015 was a dreary year for exploration. But as if the drop in numbers was not enough, the success rate of these wells fell even further.

Gran Tierra Energy (TSX:GTE) CEO Gary Guidry reaffirmed the operator’s focus on Colombia, and said that with low prices many projects will no longer be viable, presenting an opportunity for firms with a low cost structure. He also emphasized the importance of oil infrastructure.

The Ministry of Mines and Energy has lowered fuel prices in February, and highlighted the falling fuel prices over the last year.