A wave of blockades in Putumayo, Caquetá and Huila add to the 45 registered this year in a growing trend which have some speculating in the national press that companies could start suspending or canceling projects.

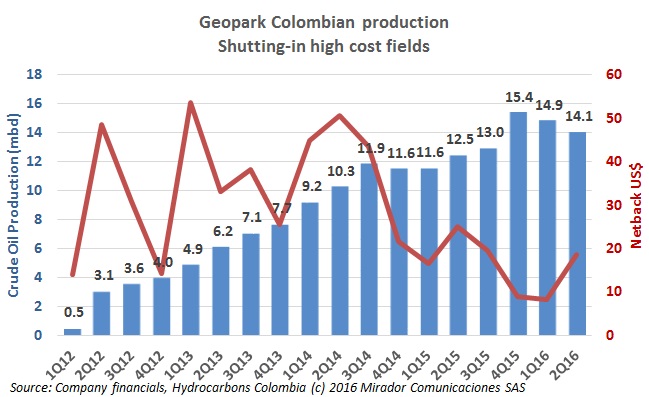

After successive production growth, Geopark´s (NYSE:GPRK) oil and gas production dropped for the first time, but the firm was able to shrink its loss compared to the first quarter and last year.

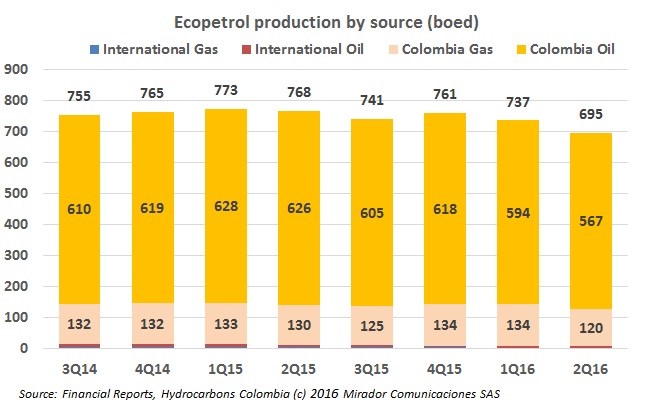

As Ecopetrol (NYSE:EC) closed an intense six months which included the operational launch of the Cartagena Refinery (Reficar), the handover of Cusiana and Rubiales and a management restructuring. The firm reported that during the second quarter its production has faltered but its financial results improve on the first quarter of the year.

The constant decline of existing gas fields like those in La Guajira, and a lack of new sources has spelled the end to an expansion of thermal generation plants designed to back up the general electrical grid.

The General Controller (CGR) Edgardo Maya Villazón has issued yet another report which found multiple ‘white elephant’ projects in 16 departments. Exactly the problems the General Royalty System and the overall of the royalty scheme were supposed to prevent.

Ecopetrol (NYSE:EC) has started the process of naming a new president for the Cartagena Refinery, with an international headhunt expected to bring an executive with precise knowledge of the petrochemical market and refining operations.