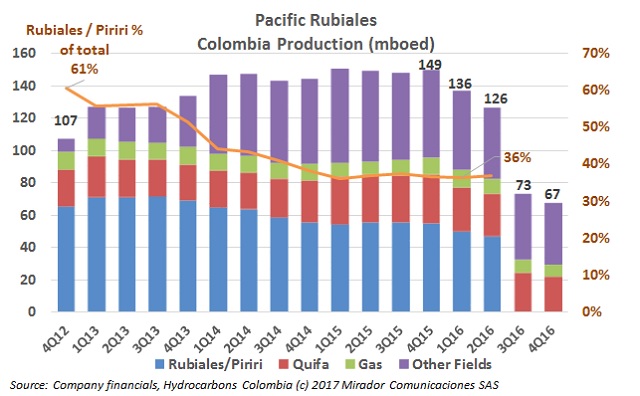

Pacific E&P (TSX: PEN) announced its financial statements for last year. The company reported a net production decrease and lower financial results, but the firm reported positive net income thanks to the restructuring.

Colombian President Juan Manuel Santos, met with members of the sector to discuss the challenges for this year. At the meeting, they also talked about the sector’s progress during last year.

This week, the last and most awaited debate regarding the Special Jurisdiction for Peace (JEP) took place in the Congress. The project was finally approved, only after senators decided more than 10 of its points had to be reformed.

The Controller General called 47 Reficar officials and members of Ecopetrol’s (NYSE:EC) board of directors for an investigation into criminal responsibility, to discuss what happened with the technical analysis of the investments and cost that were incurred in the project.

Communities often complain about low hiring of local labor. Authorities have issued a new regulation on this subject for department of Meta.

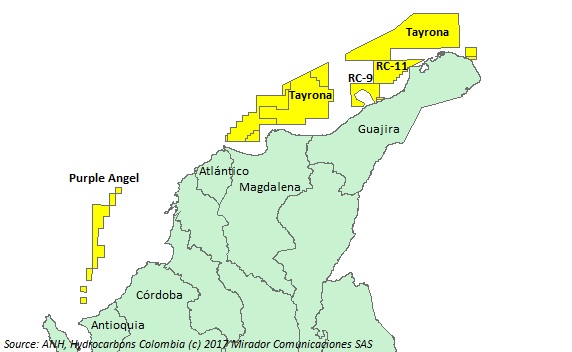

The government and authorities have been working to boost offshore exploration in Colombia and the sector is ready to start activities this year. The companies have their plans ready; only some regulations are missing.